Global Insights Hub

Stay updated with the latest trends and news from around the world.

Insurance Discounts That Drive Your Premium Down

Unlock hidden insurance discounts that can slash your premiums! Discover strategies to save big on your coverage today.

Top 5 Insurance Discounts You Might Not Know About

When it comes to saving money on your insurance premiums, many policyholders are unaware of the various discounts offered by insurers. Here are the Top 5 Insurance Discounts You Might Not Know About. First, consider the multi-policy discount. This is often available if you bundle different types of insurance, such as home and auto. Insurers frequently reward customers who consolidate their policies with significant savings.

Another often-overlooked discount is the safe driver discount. If you maintain a clean driving record without any accidents or traffic violations, you could qualify for reduced rates. Additionally, many companies offer discounts for good students, encouraging young drivers to maintain high academic standards. Lastly, don’t forget about security system discounts; installing alarms or security systems in your home or car can lead to substantial savings on your insurance premium.

How to Qualify for the Best Insurance Premium Reductions

Qualifying for the best insurance premium reductions begins with understanding the various factors that insurers assess when determining your rates. Start by maintaining a good credit score, as insurers often use this as a key indicator of risk. Additionally, consider bundling your insurance policies—combining home and auto insurance with the same provider can yield significant discounts. Another effective strategy is to increase your deductibles; the higher your deductible, the lower your premium is likely to be. Lastly, always communicate changes in your life circumstances, such as retirement or a change in occupation, which can also affect your rates.

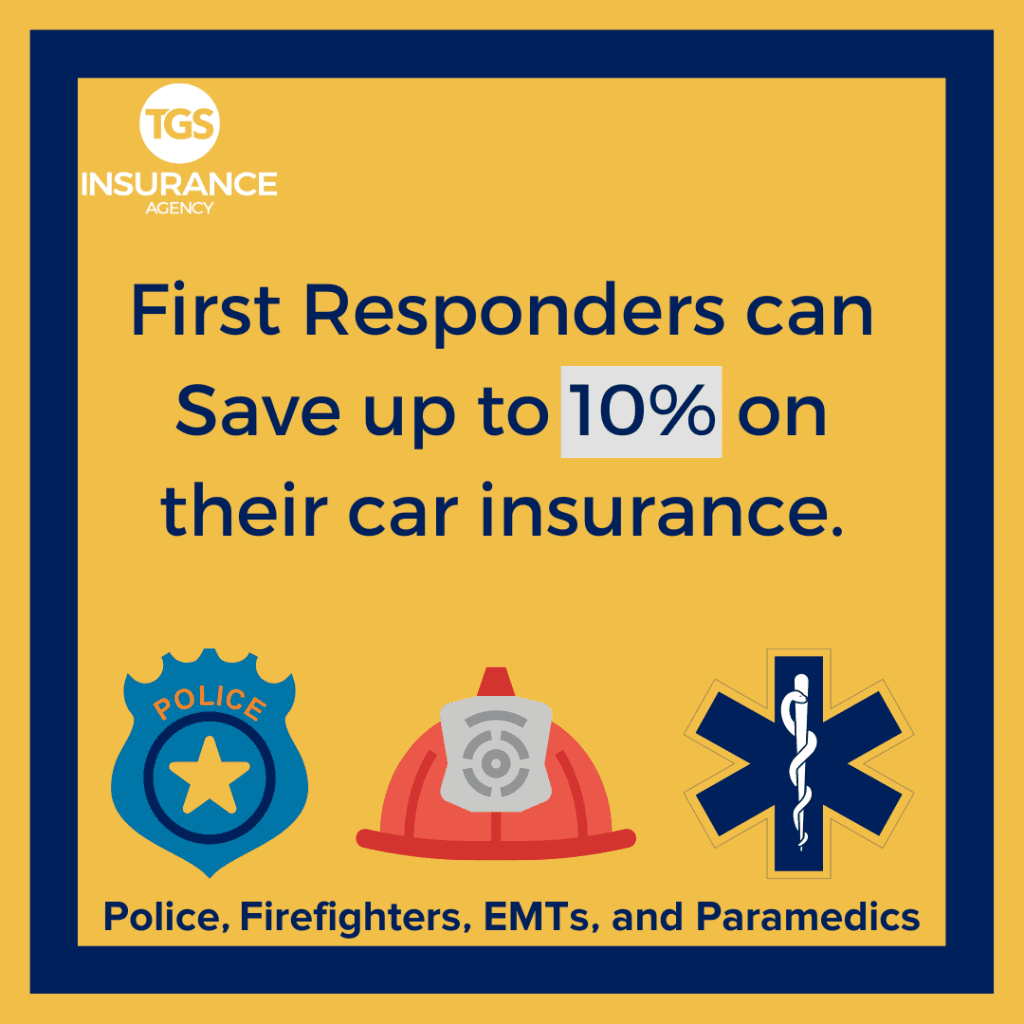

Furthermore, take advantage of available discounts by being proactive and inquiring about them. Many insurers offer premium reductions for various reasons, including safe driving records, completion of defensive driving courses, or even membership in certain organizations. It's crucial to regularly compare quotes from different insurance providers since rates can vary significantly. By scheduling annual reviews of your insurance policies, you can ensure that you are not missing out on potential savings. Remember that staying informed and actively managing your insurance needs is essential to qualifying for the best available rates.

Are You Missing Out on These Hidden Insurance Discounts?

When it comes to insurance, many people are unaware of the hidden discounts that could lead to significant savings on their policies. From bundling your home and auto insurance to maintaining a clean driving record, these opportunities often go unnoticed. Insurance providers offer various incentives to attract and retain customers, yet many policyholders either don't ask about them or fail to understand the criteria for eligibility. By taking a closer look at your insurance coverage, you may discover that you could be saving hundreds of dollars annually.

One common yet overlooked option is the loyalty discount. If you've been with your provider for several years, don't hesitate to inquire if they offer discounts for long-term customers. Additionally, consider asking about discounts for safety features in your vehicle or home. For example, having a security system or a smoke alarm can sometimes qualify you for reduced premiums. Remember, it's essential to regularly review your insurance policy and ask your agent about any hidden discounts you may be missing out on!