Global Insights Hub

Stay updated with the latest trends and news from around the world.

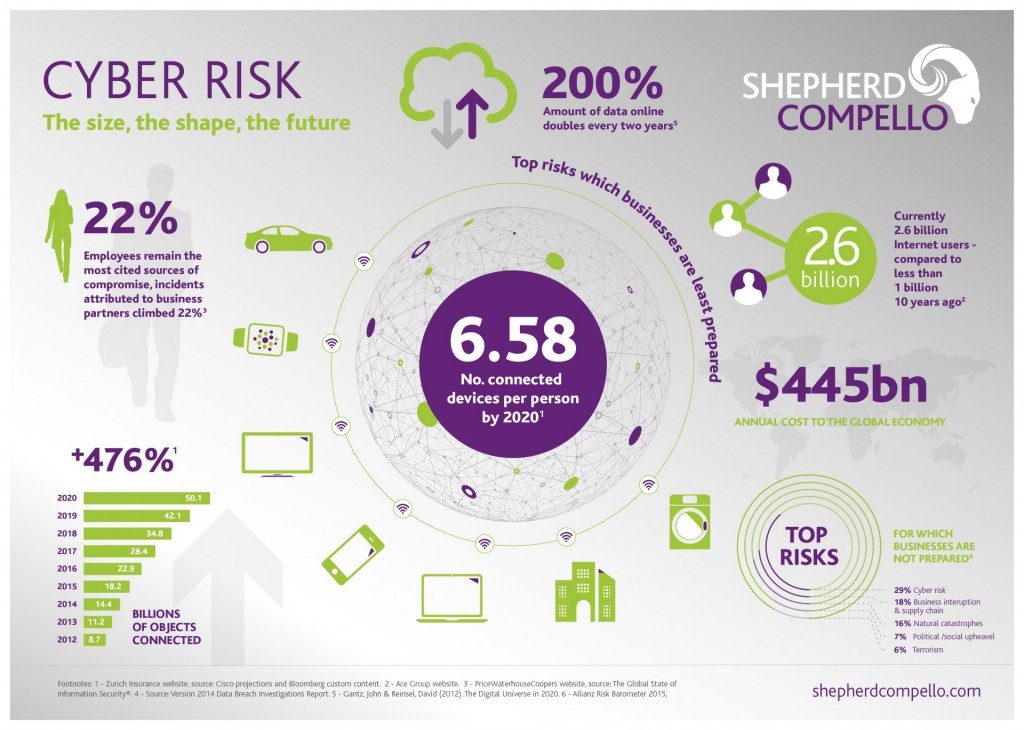

Cyber Liability Insurance: Your Business's Secret Weapon Against Online Threats

Protect your business from online threats! Discover how cyber liability insurance can be your ultimate defense strategy today.

Understanding Cyber Liability Insurance: How It Protects Your Business

Cyber liability insurance is a crucial component of modern business risk management, designed to protect organizations against the financial implications of cyber incidents.

With the increasing frequency of data breaches and cyberattacks, having a comprehensive cyber liability policy can help cover costs related to data recovery, legal fees, notification expenses, and even settlement payouts. It offers businesses peace of mind, allowing them to focus on growth rather than the aftermath of a cyber crisis.

Top 5 Reasons Why Every Business Needs Cyber Liability Insurance

In today's digital age, having cyber liability insurance is crucial for every business. With cyberattacks becoming more sophisticated and frequent, this type of insurance helps protect businesses from the financial fallout associated with data breaches and other cyber incidents. Here are the top 5 reasons why every business needs cyber liability insurance:

- Financial Protection: Cyber liability insurance provides coverage for expenses related to data breaches, such as legal fees, notification costs, and customer credit monitoring services.

- Risk Management: By investing in cyber liability insurance, businesses can better manage their risk and enhance their security protocols to prevent potential cyber threats.

- Reputation Management: A data breach can severely damage a company's reputation. Insurance can help cover the costs of public relations efforts needed to restore customer trust.

- Legal Compliance: Many industries have regulations around data protection; having the right insurance can help businesses navigate these legal requirements.

- Peace of Mind: Knowing that your business is protected against cyber risks allows you to focus on growth and innovation, rather than worrying about potential vulnerabilities.

Is Your Business at Risk? Key Questions to Ask About Cyber Liability Insurance

In today's digital landscape, cyber liability insurance has become a critical shield for businesses of all sizes. As cyber threats continue to evolve, it’s essential to regularly assess whether your business is adequately protected. Start by asking yourself key questions such as, Is my data secure? and What steps have we taken to prevent a breach? Conducting a thorough risk assessment can help identify vulnerabilities and highlight the necessity of having the right coverage in place.

Additionally, consider these crucial questions regarding your cyber liability insurance:

- What type of incidents does the policy cover?

- How does the policy respond to data breaches and third-party claims?

- What are the limitations and exclusions?