Global Insights Hub

Stay updated with the latest trends and news from around the world.

Game On: How the Competitive Gaming Economy is Shaping Digital Wealth

Explore how the booming competitive gaming economy is redefining digital wealth and transforming players into millionaires. Dive in now!

Exploring the Rise of eSports: How Competitive Gaming is Redefining Digital Wealth

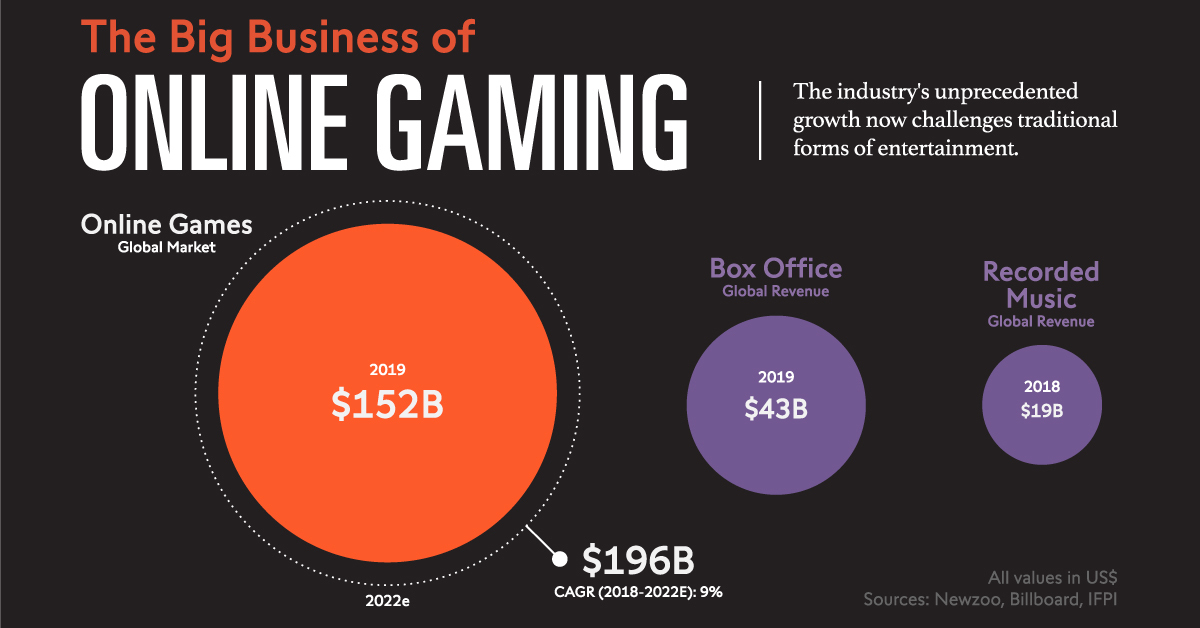

The rise of eSports has been nothing short of meteoric, transforming casual gaming into a competitive powerhouse that is captivating audiences worldwide. With tournaments drawing millions of viewers and prize pools reaching staggering amounts, competitive gaming is no longer just a niche hobby. Instead, it's evolving into a legitimate industry that is redefining how we perceive digital wealth. This shift is not only attracting top-tier talent but also leading to substantial investments from major corporations eager to capitalize on a growing fan base.

As players hone their skills and teams emerge in various genres, the landscape of eSports continues to expand. Sponsorship deals and endorsements are becoming essential revenue streams, with brands eager to associate themselves with the popularity of gaming culture. Furthermore, platforms like Twitch and YouTube are providing unprecedented avenues for gamers to monetize their content, allowing them to turn their passion into a lucrative career. This evolution highlights a fundamental change in how digital wealth is created and shared, paving the way for a new generation of stars who redefine success in the digital age.

Counter-Strike is a popular series of multiplayer first-person shooter games that emphasize teamwork and strategy. Players can engage in various game modes, from bomb defusal to hostage rescue. For players looking to enhance their gaming experience, using a csgoroll promo code can provide exciting bonuses and rewards.

The Economics of In-Game Assets: A Deep Dive into Virtual Economies

The rise of virtual economies within video games has significantly transformed the way we understand in-game assets. These digital goods, ranging from character skins to virtual real estate, now hold substantial monetary value. Players frequently engage in real-money transactions, buying and selling assets through various platforms, which has led to the emergence of complex marketplaces. According to recent studies, the global market for in-game assets is projected to reach billions of dollars, revealing a growing intersection between gaming, commerce, and technology. In these vibrant virtual spaces, the laws of supply and demand dictate asset values, where rarity and desirability can inflate prices dramatically.

Furthermore, the economic principles governing these virtual assets echo those found in traditional markets. For instance, in-game economies often experience inflation or deflation based on player behavior and developer interventions. Players can participate in crafting, gathering, and trading resources, demonstrating a microcosm of real-world economic activity. As game developers increasingly implement mechanisms such as limited-time items and player-driven marketplaces, the importance of understanding this virtual economy grows. A comprehensive grasp of the economics of in-game assets not only enhances gameplay experience but also equips players with insights that bridge the gap between digital interactions and real-life financial acumen.

How Competitive Gaming Influences Real-World Financial Markets: Trends and Predictions

Competitive gaming has evolved from casual pastimes to a significant cultural phenomenon, with implications reaching far beyond the gaming community and into the realm of real-world financial markets. The rise of esports has attracted considerable investment from both traditional sports franchises and major corporations, leading to the establishment of market trends that reflect this growing interest. As more viewers tune in to esports tournaments, media rights and sponsorships have become lucrative sources of revenue, affecting stock prices for companies involved in broadcasting and event hosting. Additionally, the introduction of non-fungible tokens (NFTs) and in-game economies is shifting how we perceive asset ownership, inviting parallels between gaming and traditional financial instruments.

As we look to the future, it is essential to consider how the intersection of competitive gaming and finance might evolve. Predictions indicate an increasing normalization of digital assets as tangible commodities, blurring the lines between entertainment and investment. Analyst forecasts suggest that companies adept at monetizing esports and gaming ecosystems may see substantial market growth. Moreover, emerging technologies such as blockchain could further integrate gaming transactions into broader financial systems, leading to new opportunities and challenges for investors. Keeping an eye on these developments will be crucial for understanding the potential impact of competitive gaming on global market dynamics.