Global Insights Hub

Stay updated with the latest trends and news from around the world.

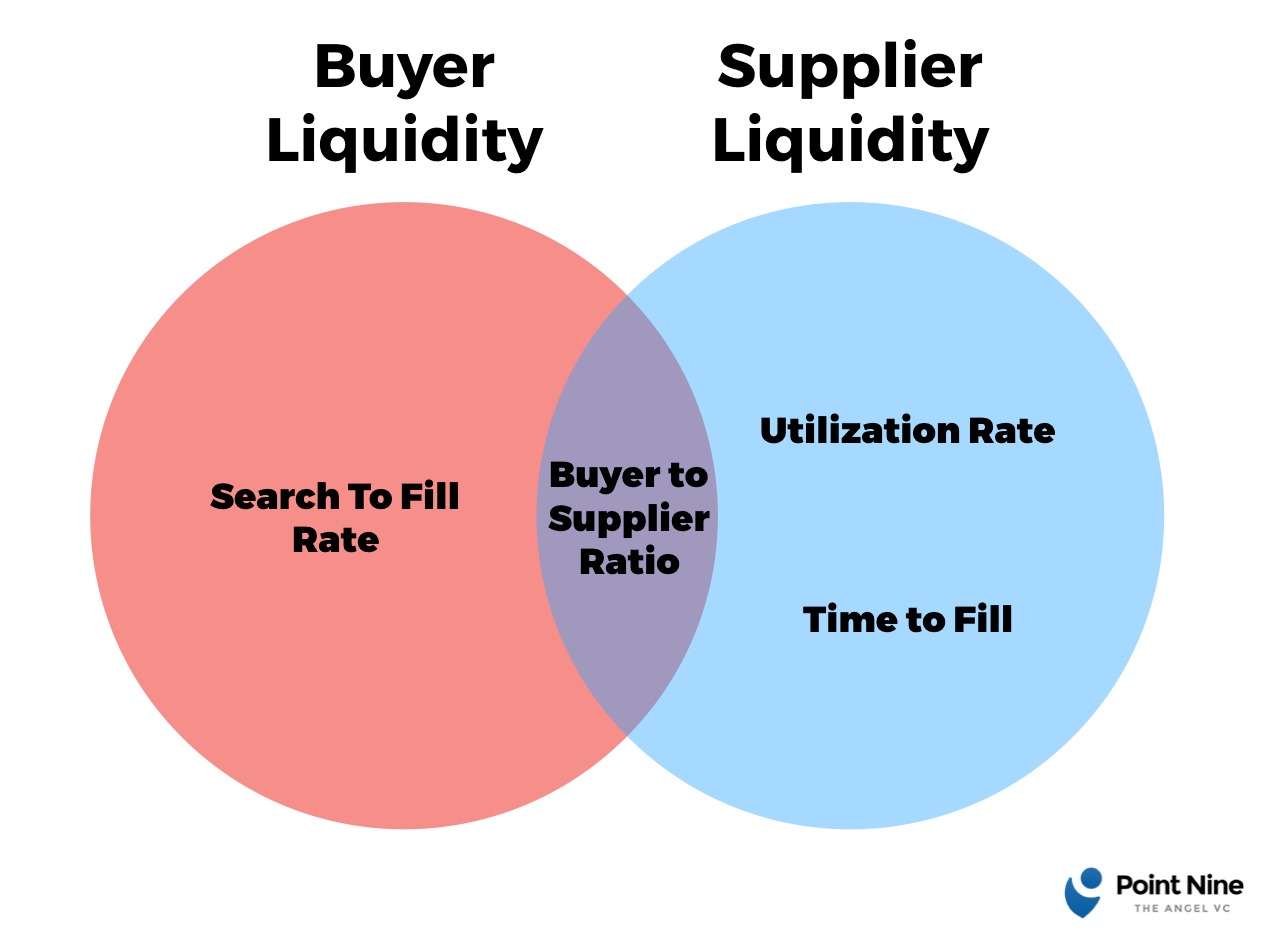

Marketplace Enigma: Deciphering the Puzzle of Liquidity Models

Unlock the secrets of liquidity models! Dive into Marketplace Enigma and uncover how they shape the future of trading. Don't miss out!

Understanding Liquidity Models: Key Concepts and Strategies

Understanding liquidity models is crucial for investors, financial analysts, and businesses alike, as they provide insights into how assets can be bought or sold in the market without significantly impacting their price. Liquidity models are grounded in key concepts such as market depth, spread, and trading volume. Market depth refers to the ability of a market to sustain large orders without substantial price changes, while the spread indicates the difference between the bid and ask price of an asset. High trading volumes generally suggest better liquidity, providing opportunities for traders to enter and exit positions efficiently.

There are several strategies that can enhance liquidity, including leveraging technology and adopting a data-driven approach. For instance, utilizing algorithms to analyze market conditions can help identify profitable entry and exit points. Additionally, maintaining a diverse portfolio can mitigate risks associated with illiquid assets. Understanding the various liquidity models can dramatically improve decision-making processes and increase the potential for successful trades, ultimately contributing to a trader's overall profitability.

Counter-Strike is a popular first-person shooter game that has been a staple in the esports community for years. Players compete in teams to complete objectives or eliminate the opposing team. For those looking to enhance their gameplay, using a daddyskins promo code can be a great way to obtain in-game skins and gear.

The Role of Market Makers: How They Influence Liquidity

Market makers play a crucial role in the financial markets by providing liquidity and facilitating smoother transactions. By continuously quoting buy and sell prices, they ensure that there is a ready supply of stock or other assets available for trading. This continuous presence in the market helps to reduce the bid-ask spread, which is the difference between the price a buyer is willing to pay and the price a seller is asking for. When market makers are active, investors can trade more easily, leading to improved price stability and less volatility.

Furthermore, the influence of market makers extends beyond simply providing liquidity; they also play a pivotal role in price discovery. By reflecting real-time demand and supply conditions, they ensure that asset prices are more accurate and less prone to manipulation. This is particularly important in volatile market conditions, where liquidity may dry up and prices can fluctuate wildly. Overall, understanding the function of market makers is essential for traders and investors alike, as they are integral to maintaining healthy market dynamics and fostering trust.

Liquidity vs. Illiquidity: What Every Investor Needs to Know

Liquidity refers to how easily an asset can be converted into cash without significantly affecting its price. In financial markets, a liquid asset, such as stocks or government bonds, can be sold quickly, providing investors with instant access to cash. Investors favor liquid assets because they offer flexibility and lower risk in times of market volatility. On the other hand, illiquid assets, like real estate or collectibles, take more time to sell, and their value may fluctuate more widely depending on demand. Understanding these differences is crucial for making informed investment choices.

When evaluating investment strategies, it's essential to consider liquidity vs. illiquidity. For example, having a portion of your portfolio in liquid assets can help you respond quickly to market opportunities or emergencies. Conversely, investing in illiquid assets can lead to potentially higher returns over the long term but may require a longer holding period. Ultimately, the right balance between liquid and illiquid investments will depend on your financial goals, risk tolerance, and individual circumstances.