Global Insights Hub

Stay updated with the latest trends and news from around the world.

Marketplace Liquidity Models: Where Buyers and Sellers Tango

Discover the secrets of marketplace liquidity models and how buyers and sellers harmonize. Dive in to unlock successful trading strategies!

Understanding the Dynamics: How Marketplace Liquidity Models Impact Buyer and Seller Interactions

Marketplace liquidity models play a crucial role in determining how effectively buyers and sellers interact within an online ecosystem. High liquidity typically means that assets can be bought and sold quickly without causing significant price fluctuations, which enhances user experience and promotes trust in the market. In contrast, low liquidity can lead to longer transaction times, difficulty in finding matching offers, and potential price instability. Understanding these dynamics allows for better strategic decisions by participants in the marketplace, influencing how they set prices, negotiate deals, and assess the value of their trades.

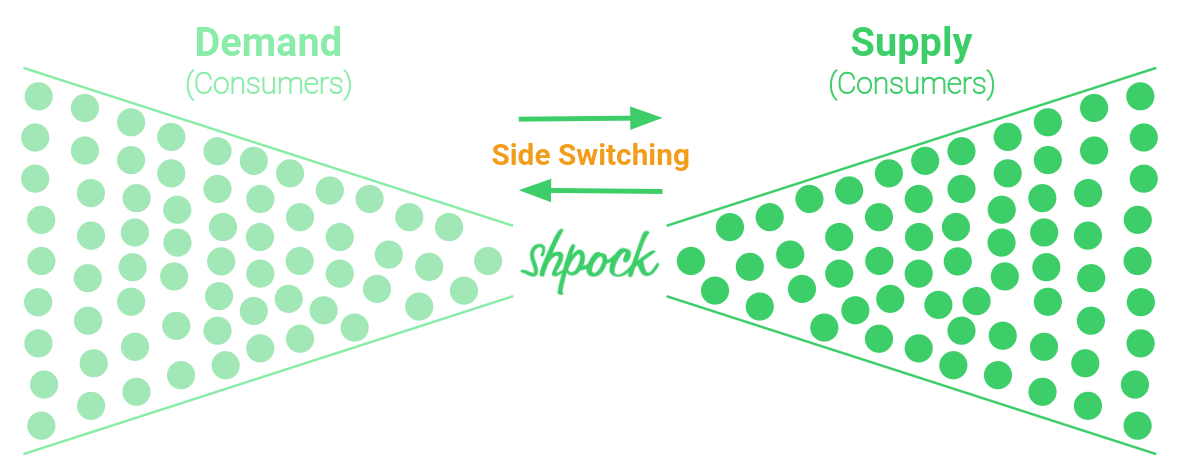

Moreover, the type of liquidity model adopted by a marketplace can significantly affect market behavior. For example, in a centralized liquidity model, a single entity manages the supply and demand, potentially leading to efficient transactions but also to issues related to control and fairness. On the other hand, decentralized models allow for peer-to-peer interactions, which can democratize access and improve liquidity but may result in greater volatility. By analyzing these models, buyers can better gauge their negotiating power while sellers can optimize their inventory strategies to align with market conditions.

Counter-Strike is a highly popular tactical first-person shooter game that first gained prominence in the late 1990s. Players can choose to play as either terrorists or counter-terrorists in various objective-based scenarios. To enhance your gaming experience, you might want to check out the daddyskins promo code for some exciting in-game advantages.

The Importance of Liquidity in Marketplaces: Strategies for Balancing Supply and Demand

Liquidity plays a critical role in the functionality and stability of marketplaces, influencing both buyer and seller behavior. In essence, liquidity refers to how easily assets can be bought or sold in the market without causing significant price fluctuations. A marketplace with high liquidity allows for more efficient transactions, which is essential for maintaining balanced supply and demand. Conversely, low liquidity can lead to volatile price movements and market inefficiencies, ultimately deterring participants. This makes it imperative for marketplace operators to implement strategies that enhance liquidity, thus fostering a more reliable trading environment.

To effectively balance supply and demand, marketplace operators can adopt several strategies. Firstly, providing incentives for sellers to list their products—such as lower fees or promotional support—can increase the available supply. Secondly, leveraging technology like predictive analytics can help to forecast demand trends, allowing operators to adjust supply accordingly. Implementing dynamic pricing models is also crucial, as they can respond to real-time market conditions. By adopting these approaches, marketplaces can enhance their liquidity, ensuring that they remain attractive to both buyers and sellers.

What Are Liquidity Models and How Do They Affect Your Marketplace Experience?

Liquidity models are essential frameworks used to determine how easily assets can be bought or sold in a marketplace without causing significant price changes. At their core, these models assess the number of resting orders, the speed of transactions, and the overall volume of activity within a trading environment. A marketplace with high liquidity tends to attract more participants because buyers and sellers can enter and exit positions quickly, which results in tighter spreads and more competitive pricing. Conversely, markets characterized by low liquidity often experience greater price volatility and wider spreads, making them less attractive to participants. Understanding the different types of liquidity models, such as centralized liquidity and decentralized liquidity, can help traders and businesses optimize their strategies and improve their overall market experience.

The impact of liquidity models on your marketplace experience is profound. A well-structured liquidity model can enhance user satisfaction and foster trust, as participants feel secure in their ability to execute trades efficiently. High liquidity usually correlates with better price discovery and lowers the risk of slippage, which is when the executed price differs from the expected price. For instance, decentralized marketplaces that utilize innovative liquidity models, like Automated Market Makers (AMMs), allow users to become liquidity providers, enhancing the overall liquidity of the space and giving traders more options. As a result, being aware of how liquidity affects market dynamics can be a game-changer for anyone looking to navigate the complex world of trading.